The Ultimate Guide to Trading Bitcoin After $1.76 Billion Liquidations

Bitcoin has once again reminded us why it’s one of the most exciting yet highly volatile and unpredictable assets. In the last 24 hours alone, over $1.76 billion in liquidations have shaken the market, impacting over 583,647 traders and causing Bitcoin’s price to drop from $100,000 to $95,000.

If you’ve been wondering how to trade or invest in this volatility without getting caught off-guard, then this guide is your answer. Whether you’re a short-term trader aiming to profit from market swings or an investor looking to build long-term wealth, you’ll walk away with actionable strategies to succeed.

Here’s the good news: You don’t have to figure it out on your own. This guide will walk you through every step—from understanding why the market corrected so sharply to mastering the strategies that work best in these crypto market conditions.

At the End of This Guide, You Will Learn:

- Why Bitcoin experienced $1.76 billion in liquidations and what it means for you.

- Proven strategies to trade and invest effectively in these highly unpredictable volatile markets.

- How to spot opportunities even during downturns and protect yourself from risks.

- The metrics you must monitor to stay ahead in the market.

By the time you finish, you’ll feel informed, and ready to make smart moves in this volatile market.

Step 1: Understand What Happened

$1.76 Billion in Liquidations – What Does It Mean?

A liquidation occurs when a trader’s position is automatically closed because they lack sufficient funds to cover their losses. This happens most often with leveraged positions, where traders borrow funds to amplify their trades.

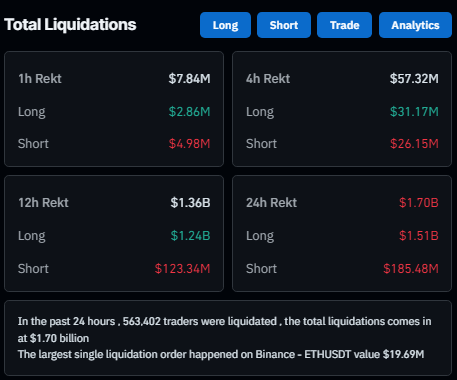

In the last 24 hours, here’s what unfolded:

- Total Liquidations: $1.76 billion, with long positions making up $1.58 billion of the total.

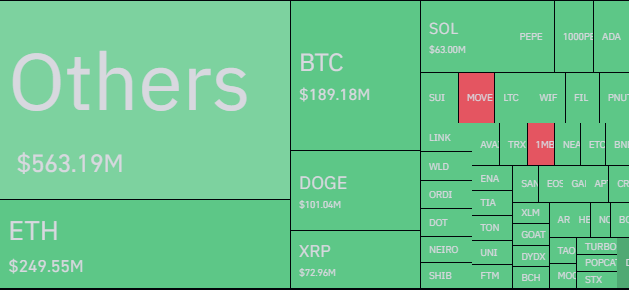

- Major Assets Affected:

- Bitcoin (BTC): $189.18 million liquidated.

- Ethereum (ETH): $249.55 million liquidated.

- Altcoins like Dogecoin (DOGE) and Solana (SOL) also saw significant losses.

This sharp correction was fueled by a combination of factors:

- Over-Leverage: Traders betting heavily on Bitcoin’s continued rise got caught off-guard.

- Profit-Taking: The $100,000 level acted as a psychological resistance, triggering sell-offs.

- Market Fear: Panic selling set in, creating a cascading effect that pushed prices lower.

Step 2: Spot the Opportunities Hidden in Chaos

While a $1.76 billion liquidation event sounds alarming, it also presents unique opportunities for traders and investors who know what to look for.

Key Opportunities in the Current Market

- Accumulation Zones: Bitcoin’s current range of $94,000–$95,000 offers a great entry point for long-term investors using Dollar-Cost Averaging (DCA).

- Altcoin Resilience: Ethereum and Solana, despite liquidation pressures, remain fundamentally strong, making them good diversification options.

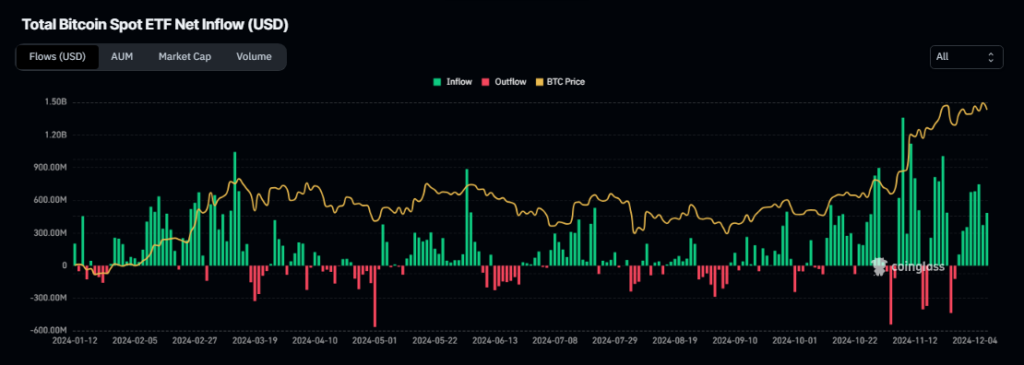

- Institutional Confidence: Major players like BlackRock and MicroStrategy are still accumulating Bitcoin, and ETFs recorded massive in inflows this week alone. This underscores long-term confidence in the asset.

Step 3: Leverage Proven Trading Strategies

For Active Traders

The current market is ripe with trading opportunities, but you need a plan. Here’s how to navigate the volatility:

1. Scalp Trading for Quick Profits

- Focus on Bitcoin’s price range of $94,000–$100,000.

- Look for short-term price movements and take profits quickly.

- Use tight stop-loss orders to protect your capital if the price moves against you.

2. Confirmed Breakout Trades

- Above $100,000: Go long with targets at $103,000 and $105,000.

- Below $94,000: Consider shorting with a target of $90,000.

3. Monitor Volume for Confirmation

Before entering a trade, ensure there’s a strong trading volume to validate the move. Low volume often signals false breakouts or breakdowns.

Step 4: Build Wealth with Smart Investing

For Long-Term Investors

If you’re focused on building wealth, your strategy should prioritize consistency over timing the market.

1. Use Dollar-Cost Averaging (DCA)

- Buy a fixed amount of Bitcoin regularly, regardless of its price.

- For example, invest a certain amount weekly whether Bitcoin is at $95,000 or $90,000. This reduces the risk of making poor timing decisions.

2. Diversify Your Portfolio

- Allocate a large percentage of your crypto holdings to Bitcoin and Ethereum for stability.

- Use the remaining 30% to invest in high-growth altcoins like Solana, Dogecoin, and XRP.

3. Hedge with Stablecoins

- Convert a portion of your portfolio to stablecoins like USDT to safeguard against sudden market downturns.

Step 5: Avoid Common Mistakes

What You Must Avoid

- Over-Leverage: Using too much leverage in a volatile market can lead to liquidation. Keep leverage to a minimum. Focus on spot trading.

- Emotional Trading: Avoid panic buying or selling based on market swings. Stick to your strategy.

- Ignoring Stop-Losses: Always set stop-loss orders to protect your positions.

Step 6: Monitor Key Metrics

To stay ahead in this market, keep an eye on the following:

- Support Levels: $94,000 is critical; a breach could lead to $90,000.

- Resistance Levels: $100,000 remains the major hurdle for Bitcoin to overcome.

- Liquidation Trends: Track the volume of liquidations to gauge market sentiment.

- Institutional Inflows: ETF activity and corporate purchases are strong indicators of long-term confidence.

Support Levels to Watch

1. Immediate Support: 100 EMA (4-Hour Chart)

- Status: The 100 EMA on the 4-hour chart has acted as strong support so far.

- Key Indicator: A close below this level, especially with significant volume, would signal a potential breakout and shift in momentum.

2. Next Major Support: 200 EMA (4-Hour Chart)

- Position: If the price breaks below the 100 EMA, the 200 EMA is the next critical level to watch.

- Significance: The 200 EMA serves as a technical support level and is a common target after the 100 EMA breach.

3. Psychological Support: $90,000

- Why It Matters:

- Aligns closely with the 200 EMA, reinforcing its strength as a support zone.

- Acts as a psychological barrier, often influencing market sentiment and trader behavior.

Key Actions for Traders:

- Monitor Closely: Observe price action and volume around the 100 EMA to confirm or reject a breakout.

- Validate Breakout: A sustained close below the 100 EMA with volume indicates a higher probability of testing the 200 EMA.

- Prepare for $90,000: If the 200 EMA fails, expect a potential move toward the psychological $90,000 level.

These support levels provide critical checkpoints to assess market behavior and inform trading or investment decisions.

Step 7: Manage Risk Like a Pro

Risk management is the cornerstone of successful trading and investing. Here’s how to do it right:

- Use Tight Stop-Losses: Protect yourself from sharp market movements.

- Limit Leverage: Stick to low leverage (no more than 3x) to minimize risks.

- Stay Agile: Be prepared to adjust your strategy as market conditions evolve.

Step 8: Take Immediate Action

The market won’t wait for you, so it’s time to act. Here’s what you should do next:

- For Traders: Use scalp and breakout strategies to capitalize on price movements.

- For Investors: Start accumulating Bitcoin using DCA and diversify into altcoins.

- For Everyone: Monitor liquidation trends, Whales, Bitcoin ETF, and institutional activity to stay informed.

Step 9: Keep Learning and Growing

Bitcoin’s recent liquidation wave is a valuable learning opportunity. Commit to improving your knowledge and refining your strategies.

Next Steps:

- Bookmark this guide for future reference.

- Share your experience in the comments—what’s your strategy in this market?

- Sign up for updates to stay informed about the latest trends and strategies.

Final Thoughts

The $1.76 billion liquidation event underscores both the risks and opportunities in the cryptocurrency market. Whether you’re a trader looking for short-term gains or an investor focused on the long haul, the key to success lies in having a solid plan and sticking to it.

Bitcoin’s volatility can be intimidating, but with the right approach, you can navigate it confidently. Remember, the market rewards those who are prepared. Are you ready to take your trading and investing to the next level?

Let us know your thoughts below, and don’t forget to share this guide with others who want to master Bitcoin’s dynamic market!